According to a report by Nuveen Investments, a state law passed in 2010 -- but that only kicks in next year -- Chicago must massively increase its pension payments in 2016. And I do mean MASSIVELY.

Based on state law and recent actuarial valuations, Chicago is required to contribute $839 million to its policemen’s and firemen’s pensions in 2016 ... But the city has only budgeted for a pension levy of $290.4 million.That means that the city has to pay an additional $540 million. In ONE year.

Where are they going to get that much money? They only have a couple legitimate options, none of them good. The best one is to jack up property taxes ... by almost 50%.

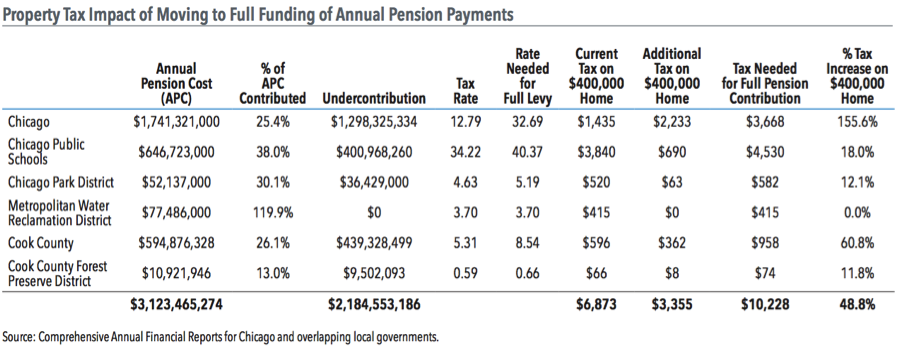

To get a sense of the magnitude of the property tax increases necessary to move to full funding of annual pension payments, Nuveen Asset Management analyzed the 2013 property tax levies, pension payments and Annual Pension Costs (APC) for Chicago and its overlapping taxing districts as reported in their respective audited financial statements. We analyzed the tax bill of a theoretical $400,000 home in Chicago under current tax requirements and a scenario under which the city and its overlapping taxing districts all make full annual pension payments. ... All tax figures are from each entity’s 2013 fiscal year – the most recent fiscal year in common for all issuers.Increasing property taxes by 5% causes loud grumbling and hardship. Increasing them by 10% leads to people with the means to do so to leave the city in droves as soon as they can. Increasing them by 50%? I can't imagine it.

Based on our review of each government’s fiscal 2013 audited financial statements, the owner of a $400,000 home would have paid approximately $6,873 in property taxes. ... Altogether, the owner of a $400,000 home in Chicago would need to pay $3,355 in additional property taxes to support full annual pension contributions – increasing the tax bill to $10,228 for a single year jump of nearly 49%.

There's no way Rahmbo makes it to a third term after doing this, and he's got to know that. He's also got to know that he can't avoid it. Daley mortgaged the future and Rahm got stuck with the check.

But really -- this is the inevitable endpoint of Progressive government (unless you're a mono-cultural Scandinavian country, and even then things can get dicey). As the Iron Lady said, "At some point, you run out of other people's money." That moment is rapidly approaching in Chicago.

No comments:

Post a Comment